Which health insurance does really make sense for me?

When Obrist Helps does a «policy-check»for new customers, we often get surprised how their current insurance was chosen. Do you know what parameters are actually used for the health insurance premium?

Well, whether you like it or not, it is based on the following two main factors:

Factor 2: The age – There are three classes (until 18, 19-25, and from 26 old)

priminfo.admin.ch

In our point of view, the best way to evaluate an insurance of your needs is using Priminfo. With the following link, everyone can check themselves, which insurance is the cheapest based on their location and age: https://www.priminfo.admin.ch/de/praemien. Priminfo is a federal website which provides reliable and up to date information.

Let me show you how to use it :)

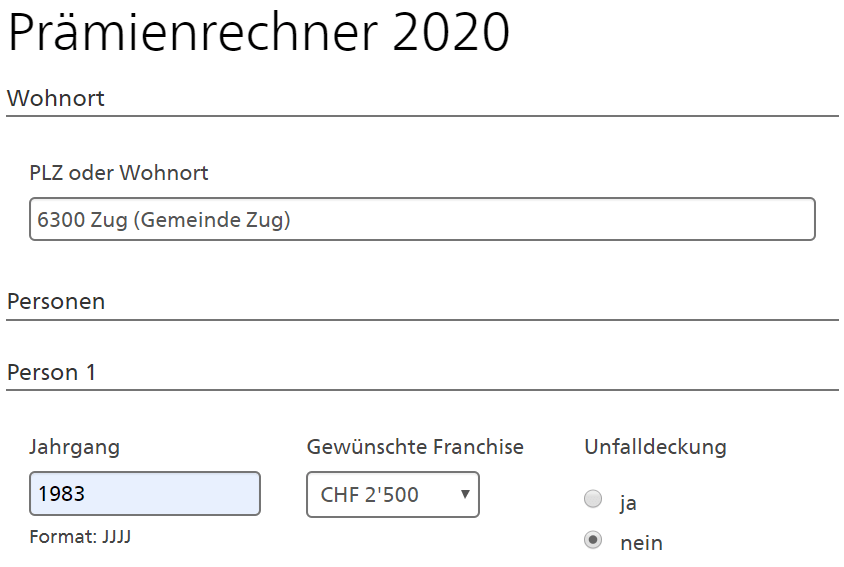

Let's take an example – Male, 36 yrs old (let’s call him Mike)

Mike is 36 years old and is living in 6300 Zug. He is employed that means he does not need any accidental coverage in the basic insurance. So now, Mike goes to the priminfo website and enters his information. As he is not often going to the doctor, he chose the highest franchise of CHF 2’500.-.

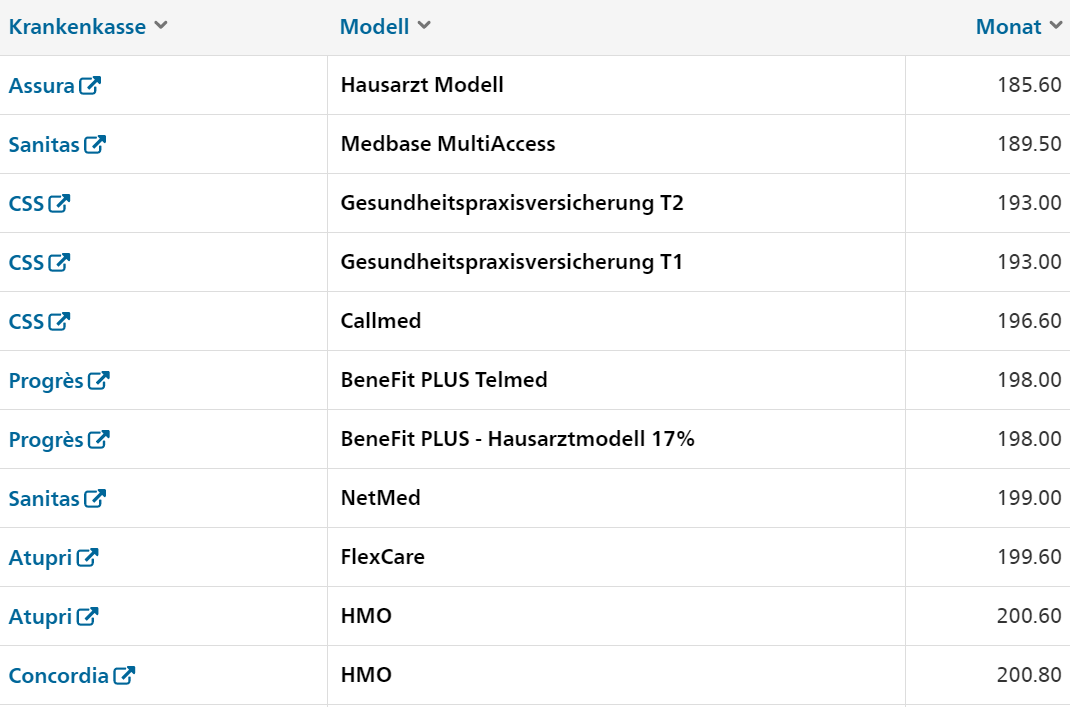

Results

As you can see, Assura is usually one of the cheapest insurances, as well for Mike. Depending on the doctor model you choose (Free choice of doctor, house doctor, HMO, Telmed etc.), for a few francs more, Mike can get an insurance like Sanitas, CSS, Helsana, etc. which are recognized as«proper insurances»with a better service level.

Side note: In addition to the doctor model, the pricing depends as well on the strategy of the health insurance e.g., Sanitas is an attractive provider for young people until the age of 25.

Do not let yourself sell an insurance which is not attractive based on priminfo results (As some insurance brokers and agents often sell insuranceswhere they can earn the most). For us it is a quality sign, when a broker offers a senseful health insurance, based on priminfo.

Splitting basic and supplementary insurances – a good idea?

This is a very subjectively decision to make. Most of the customers of Obrist Helps prefer to have basic and supplementary insurances with the same provider. Others like to have the cheapest basic insurance and keep additionally good supplementary insurances with a«good» or«better»company. But note that it could become an administrative chaos in case you have a hospital stay and some reimbursements are covered from the basic, others from the supplementary insurance. This we recommend to keep in mind.

Check once if your health insurance is attractive where you live

Now you know the little secret of an honest health insurance consultation (which in fact is really no rocket science). You can check it yourself or ask an expert for help. Priminfo is a great tool to compare the basic insurance, but there are many more other factors that should be considered (coverage in supplementary insurances, service level and benefits), that's where an expert can help you to choose the best insurance. Obrist Helps can double check your policy in a transparent manner.